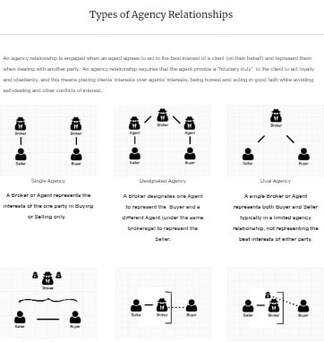

Wyoming Out of State Broker Cooperation- An out-of-state licensee can receive commission split from Wyoming licensee, so long as out-of-state licensee conducts no negotiations within Wyoming for the transaction.

- Case law allows out-of-state licensee to enter Wyoming and work on transaction, so long as the out-of-state licensee does not conduct negotiations within the state. |

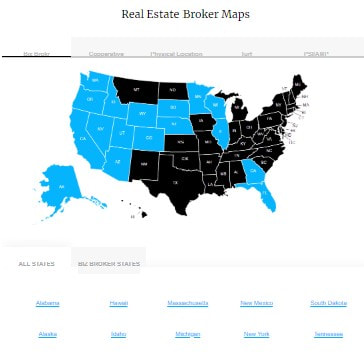

POSSIBLE BIZ BROKER STATE |

|

|

Wyoming Real Estate ReciprocityAny State *

*Individuals must submit fingerprints, complete and pass the Wyoming Law Portion of the Broker I Course, complete and pass all of Broker II Course, complete and pass the Broker Management Class (Responsible Broker Only), and pass the State Exam for Responsible Brokers before applying Confirmed by Wyoming Real Estate Commission |

Specific to Wyoming Real Estate - Broker Trust Account required, not necessarily in State. |

Wyoming Reverse ReciprocityThese states specifically mention Wyoming in their Reciprocity: Montana, Ohio These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

Wyoming Real Estate LinksWyoming has no Reciprocity Page Wyoming Real Estate Commission POSSIBLE BIZ BROKER STATEAlthough websites abound that say Wyoming is a state where a Business Broker is required to hold a real estate license, no mention of business opportunities was found in the code or the definition of real property. |

Wyoming Real Estate Customs

Real estate agents generally conduct closings.

Conveyance is by warranty deed. Mortgages are the usual security instruments.

Wyoming uses ALTA owner’s and lender’s policies and endorsements.

Buyer and seller negotiate who’s going to pay the various closing costs and title insurance fees.

There are no documentary, mortgage, or transfer taxes.

Property taxes may be paid annually or semi-annually.

Wyoming is a NON-DISCLOSURE state. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.

Wyoming has no state income tax.

Conveyance is by warranty deed. Mortgages are the usual security instruments.

Wyoming uses ALTA owner’s and lender’s policies and endorsements.

Buyer and seller negotiate who’s going to pay the various closing costs and title insurance fees.

There are no documentary, mortgage, or transfer taxes.

Property taxes may be paid annually or semi-annually.

Wyoming is a NON-DISCLOSURE state. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.

Wyoming has no state income tax.