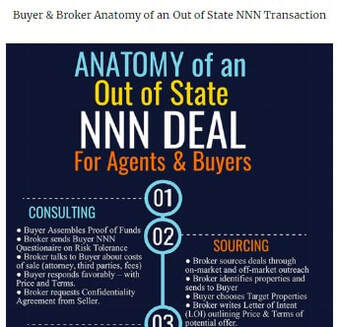

Missouri Out of State Broker Cooperation- An out-of-state licensee may render licensed services in a real estate transaction after executing a cooperative brokerage agreement with a Missouri broker and consenting to Missouri jurisdiction for litigation and disciplinary matters.

|

|

|

Missouri Real Estate ReciprocityNone* Pulled Directly from Missouri Rea Estate Commission Statutes & Rules BOARD RULE CH. 4, PAGE 3: "2. An individual holding a current and active broker license in another state or jurisdiction, other than those states and jurisdictions that issue only broker licenses, must have twenty-four (24) of the last thirty (30) months active license experience as a salesperson or broker, pass the state portion of the Missouri broker exam, and apply for licensure within six (6) months of passing the state portion of the Missouri broker exam. The forty-eight (48)-hour broker pre-examination course shall be waived." |

Specific to Missouri Real Estate |

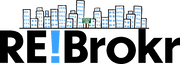

Missouri Reverse ReciprocityThese states specifically mention Missouri in their Reciprocity: None These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

Missouri Real Estate Links |

Missouri Real Estate Customs

Title companies, lenders, real estate agents, and attorneys may conduct closings.

In the St. Louis area, title company closings predominate.

In the Kansas City area, an escrow company or a title company generally conducts the closing.

Conveyance is by warranty deed. Deeds of trust are the customary security instruments and allow private power of sale. The trustee must be named in the deed of trust and must be a Missouri resident.

Missouri uses ALTA policies and endorsements.

Buyers and sellers generally split the closing costs. Sellers in western Missouri usually pay for the title insurance polices, while elsewhere the buyers pay. There are no documentary, mortgage, or transfer taxes.

Property taxes are payable annually.

Some counties in Missouri are considered NON-DISCLOSURE. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.

In the St. Louis area, title company closings predominate.

In the Kansas City area, an escrow company or a title company generally conducts the closing.

Conveyance is by warranty deed. Deeds of trust are the customary security instruments and allow private power of sale. The trustee must be named in the deed of trust and must be a Missouri resident.

Missouri uses ALTA policies and endorsements.

Buyers and sellers generally split the closing costs. Sellers in western Missouri usually pay for the title insurance polices, while elsewhere the buyers pay. There are no documentary, mortgage, or transfer taxes.

Property taxes are payable annually.

Some counties in Missouri are considered NON-DISCLOSURE. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.