New Hampshire Out of State Broker Cooperation- An out-of-state licensee can share a commission with New Hampshire licensee so long as out-of-state licensee is performing actions legal within out-of-state licensee's state.

- An out-of-state licensee must enter into a cooperative agreement with New Hampshire licensee. |

|

|

New Hampshire Real Estate ReciprocityRecently the oplc.nh.gov website has been changed to reflect no reciprocity page whatsoever, however, in the past, 4 states had reciprocal agreements with New Hampshire: Massachusetts, Maine, Vermont, Georgia* * All States must take the state portion of the New Hampshire licensing exam. No confirmation of reciprocity could be found at New Hampshire Real Estate Commission |

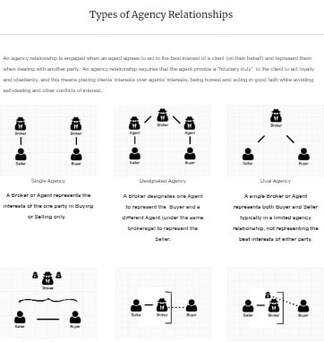

Specific to New Hampshire Real Estate- State requires a Surety Bond of at least $25,000 - NH is considered a Single Entity State, meaning that a Broker in this state can only represent one entity, whereas a broker in other states may represent multiple entities. |

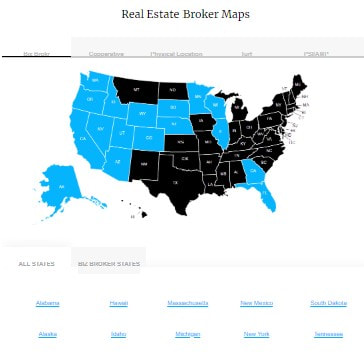

New Hampshire Reverse ReciprocityThese states specifically mention New Hampshire in their Reciprocity: None These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

New Hampshire Real Estate LinksNo Reciprocity Page New Hampshire Real Estate Commission |

New Hampshire Real Estate Customs

Attorneys conduct real estate closings.

Conveyance is by warranty or quitclaim deed. Mortgages are the customary security instruments.

The people of New Hampshire use ALTA owner’s and lender’s policies.

Buyers pay all closing costs and title fees except for the documentary tax; that’s shared with the sellers.

Property tax payment dates vary across the state.

Conveyance is by warranty or quitclaim deed. Mortgages are the customary security instruments.

The people of New Hampshire use ALTA owner’s and lender’s policies.

Buyers pay all closing costs and title fees except for the documentary tax; that’s shared with the sellers.

Property tax payment dates vary across the state.