Buyer NNN Questionnaire

What is my risk tolerance?

When calculating a clients risk tolerance it's important to talk about several factors, such as the tenant's credit rating and ability to pay rent, the Length of Lease remaining, the Location in terms of markets (primary, secondary, tertiary) as well as area location (Infill, signalized corner, ingress/egress and other qualities), the Building type complexity, the Business Location Performance History and market Interest Rate Timing.

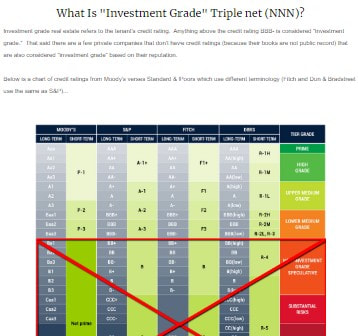

Credit Ratings (What is my risk tolerance for a tenant that may not be able to pay rent?)

Credit ratings are a huge part of net leased (NNN) properties. Unlike other types of commercial real estate, NNN properties are valued like bond. And just like bonds, credit ratings give a buyer a snapshot of the tenant's value. This is why the properties with the most credit worthy tenants have the lowest cap rates and least risk, whereas the properties with the least credit worthy tenants have high cap rates and most risk.

Question: What's the minimum cap rate that the investor will consider?

Question: What's the minimum cap rate that the investor will consider?

Length of Lease Remaining (What is my risk tolerance for re-renting the building?)

The length of remaining lease plays a role in risk as well. The longer the lease, the more assurance a buyer has of recouping an investment. Typically the first full term of a lease pays back a majority of the purchase price, so the longer leases have less risk. A sub-sector of lease term is Amortization risk.

Question: What would the Buyer Prefer?

Question: What would the Buyer Prefer?

Amortization (What is my risk tolerance for cash flow? Shorter leases will cost more cash flow)

A sub-sector of lease term is Amortization risk. Properties with shorter leases will not not have the same Amortization that longer leased properties have. A shorter amortization will decrease the monthly cash flow of the property, putting the rent at higher risk than a similar property that has a higher cash flow allowing for reserves to be created.

Question: How important to daily life is the cash flow of the asset?

Question: How important to daily life is the cash flow of the asset?

Location - Markets (What is my risk tolerance for a smaller population to serve?)

Markets are broken down into Primary, Secondary and Tertiary when referring to size, revenue and population. Buying a property in a more established market will have less risk and lower cap rates than in a less established market.

Question: How well does the Investor know the market where they are investing?

Question: How well does the Investor know the market where they are investing?

Location - City location (What is my risk tolerance for a hard corner vs middle of the street position?)

The actual location in any given market plays a role as well. While the value of most NNN properties is based on the tenant, risk can be mitigated buying infill properties, with signalized corner locations, with strong ingress egress and future development potential.

Question: How much value does the investor want to put toward the real estate?

Question: How much value does the investor want to put toward the real estate?

Building Type Complexity (What is my risk tolerance for the tenant staying after the lease expires?)

The building complexity factor mainly plays a role in re-renting. The risk with any property is structural obsolescence when a tenant vacates (also known as going "dark"), and the ability to re-rent the property. Simple box-shaped buildings consisting of "tilt-up" construction are typically more lease-able because they appeal to a wider range of tenants and are therefore less risky purchases. More complex buildings are typically more specialized (even if the rent is higher), and are more risky due to the smaller buyer pool when it comes to leasing.

Question: How interested is the investor in "pride of ownership?"

Question: How interested is the investor in "pride of ownership?"

Business Location Performance History (What is my risk tolerance for the business surviving Amazon?)

The historical business location performance of any property adds another layer of risk to most investments. A business that has been in the same location for long periods of time, with known sales to outperform other locations will typically be less risky than new business locations with little or no history.

Question: How speculative does the investor want to be?

Question: How speculative does the investor want to be?

Interest Rate Timing Risk (What is my risk tolerance for selling when there's a lower interest rate?)

Interest Rate timing risk is more macroeconomic than having to do with the real estate itself, but must be considered. Most investors want potential upside along with a solid rate of return and passivity in NNN properties. Interest rates effect NNN properties more than other types because of the cap rate value by which most properties are sold. If a NNN property is purchased when interest rates are at their lowest, than all interest rates can do is go up, decreasing the value of the property over the hold period. In high or low interest periods, banks spreads will primarily remain the same - making low interest rate purchases inherently more risky than higher interest rate purchases.

Question: How important is passivity in the investors portfolio?

Question: How important is passivity in the investors portfolio?