California Out of State Broker Cooperation- An out-of-state licensee can perform no acts in California.

- An out-of-state licensee can receive a referral fee and can share a commission if his or her acts in furtherance of the sale occur outside of California. - An out-of-state licensee can bring a lawsuit in California, so long as the lawsuit isn’t for any actions which required a California real estate license. |

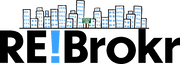

BIZ BROKER STATE |

|

|

|

|

Specific to California Real Estate |

California Reverse ReciprocityThese states specifically mention California in their Reciprocity: Nevada (Salesperson Only), Virginia These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

California Real Estate LinksBIZ BROKER STATEThe rules are very clear in this State that a Business Broker must hold a real estate license to sell a business.

The statutory merger of the real estate and business opportunity licenses occurred in 1966. Since then, a real estate license is required to engage as an agent in the sale or lease of business opportunities. https://www.dre.ca.gov/files/pdf/refbook/ref24.pdf |

California Real Estate Customs

Escrow procedures differ between Northern and Southern California, and from county to county.

Title companies handle closings through escrow in Northern California. Escrow companies and lenders handle them in Southern California. Conveyance is by grant deed.

Deeds of trust with private power of sale are the security instruments used throughout the state.

Californians have both ALTA and CLTA policies available.

In Southern California, sellers pay the title insurance premium and the transfer tax. Buyer and seller split the escrow costs.

In the Northern California counties of Amador, Merced, Plumas, San Joaquin, and Siskiyou, buyers and sellers share title insurance and escrow costs equally.

In Butte County, sellers pay 75%; buyers pay 25%. In Alameda, Calaveras, Colusa, Contra Costa, Lake, Marin, Mendocino, San Francisco, San Mateo, Solano, and Sonoma counties, buyers pay for the title insurance policy, whereas sellers pay in the other Northern California counties.

Each California county has its own transfer tax; some cities have additional charges.

California is a community-property state.

Title companies handle closings through escrow in Northern California. Escrow companies and lenders handle them in Southern California. Conveyance is by grant deed.

Deeds of trust with private power of sale are the security instruments used throughout the state.

Californians have both ALTA and CLTA policies available.

In Southern California, sellers pay the title insurance premium and the transfer tax. Buyer and seller split the escrow costs.

In the Northern California counties of Amador, Merced, Plumas, San Joaquin, and Siskiyou, buyers and sellers share title insurance and escrow costs equally.

In Butte County, sellers pay 75%; buyers pay 25%. In Alameda, Calaveras, Colusa, Contra Costa, Lake, Marin, Mendocino, San Francisco, San Mateo, Solano, and Sonoma counties, buyers pay for the title insurance policy, whereas sellers pay in the other Northern California counties.

Each California county has its own transfer tax; some cities have additional charges.

California is a community-property state.