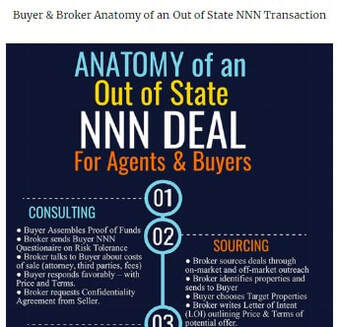

Mississippi Out of State Broker Cooperation- An out-of-state licensee cannot act within the Transaction State except with the cooperation of a Mississippi broker. - Whenever an out-of-state licensee enters into a written cooperative agreement with a Mississippi broker, the Mississippi broker shall file (within 10 days of execution of the agreement) a copy with the real estate commission.

- When the out-of-state licensee signs this agreement, that out-of-state licensee agrees to abide by Mississippi law, and the rules and regulations of the committee. - Further, the showing of the property and negotiations pertaining to the transaction shall be supervised by the Mississippi broker. |

|

|

Mississippi Real Estate ReciprocityConfirmed in Forms and Documents Only - Mississippi's "How to Obtain a Real Estate License in Mississippi" |

Specific to Mississippi Real Estate - Mandatory E&O (see RISC) https://www.risceo.com/states/mississippi/ |

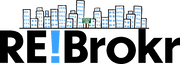

Mississippi Reverse ReciprocityThese states specifically mention Mississippi in their Reciprocity: Arkansas, Connecticut, Florida, Iowa, Louisiana, New York, Massachusetts, Ohio, Utah, West Virginia These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

Mississippi Real Estate LinksReciprocity Page (This site is very limited on Reciprocity) Non Resident Broker Application Mississippi Real Estate Commission |

Mississippi Real Estate Customs

Attorneys conduct real estate closings.

Conveyance is by warranty deed. Deeds of trust are the customary security instruments.

Mississippi uses ALTA policies and endorsements.

Buyers and sellers negotiate the payment of title insurance premiums and closing costs.

There are no documentary, mortgage, or transfer taxes.

Property taxes are payable on an annual basis.

Mississippi is a NON-DISCLOSURE state. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.

Conveyance is by warranty deed. Deeds of trust are the customary security instruments.

Mississippi uses ALTA policies and endorsements.

Buyers and sellers negotiate the payment of title insurance premiums and closing costs.

There are no documentary, mortgage, or transfer taxes.

Property taxes are payable on an annual basis.

Mississippi is a NON-DISCLOSURE state. Transaction details and the Buyer, Seller, Sales Price, or even if a property sold is NOT PUBLIC RECORD.