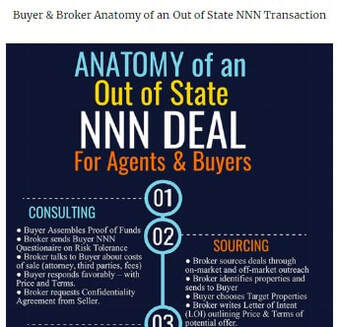

New Jersey Out of State Broker Cooperation- An out-of-state licensee may only receive a referral fee from New Jersey licensee (IF the Broker receives a REFERRAL AGENT LICENSE).

- "Referral" is defined as introducing or directing a consumer to a New Jersey licensee. - An out-of-state licensee can bring a lawsuit to collect referral fee. - Note -case law interprets New Jersey statutes as PL. |

|

|

New Jersey Real Estate Reciprocity(New Jersey does not have reciprocity with any state.)

New York, Pennsylvania* * New York and Pennsylvania has Experience & Education Waivers for Brokers. - Broker Licenses require a) one 30-hour course in Agency/Ethics and one 30-hour course in Office Management AND b) Take the New Jersey Exam. Confirmed by New Jersey Real Estate Commission |

Specific to New Jersey Real Estate |

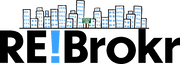

New Jersey Reverse ReciprocityThese states specifically mention New Jersey in their Reciprocity: Nevada (Salesperson Only) These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

New Jersey Real Estate Links |

New Jersey Real Estate Customs

Attorneys handle closings in northern New Jersey, and title agents customarily handle them elsewhere.

Conveyance is by bargain-and-sale deed with covenants against grantors’ acts (equivalent to a special warranty deed). Mortgages are the most common security instruments though deeds of trust are authorized.

New Jersey uses ALTA owner’s and lender’s policies.

Both buyer and seller pay the escrow and closing costs. The buyer pays the title insurance fees, and the seller pays the transfer tax.

Property taxes are payable quarterly.

Conveyance is by bargain-and-sale deed with covenants against grantors’ acts (equivalent to a special warranty deed). Mortgages are the most common security instruments though deeds of trust are authorized.

New Jersey uses ALTA owner’s and lender’s policies.

Both buyer and seller pay the escrow and closing costs. The buyer pays the title insurance fees, and the seller pays the transfer tax.

Property taxes are payable quarterly.