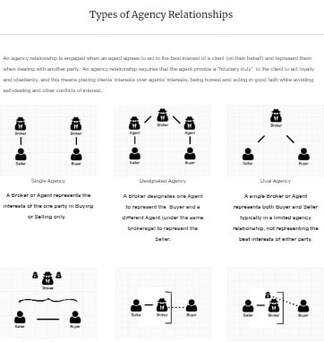

Maryland Out of State Broker Cooperation- An out-of-state licensee can receive temporary license from Commission for specific real estate transaction.

- An out-of-state licensee must: a) file a license application with Commission, b) listing all salespeople who will work on transaction as well as consenting to jurisdiction in the state; c) enter into a cooperative arrangement with Maryland broker specifying commission amounts as well delineating responsibility; d) file cooperative agreement with Commission. |

|

|

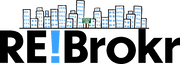

Maryland Real Estate ReciprocityPennsylvania, Oklahoma*

* Pennsylvania applicants are excused from Exams and Continuing Education (CE). Oklahoma applicants must pass the State exam but are excused from CE. ** Any State may apply for Waivers but must pass the Exam. Confirmed by The Maryland Department of Labor, MREC |

Specific to Maryland Real Estate |

Maryland Reverse ReciprocityThese states specifically mention Maryland in their Reciprocity: DC, Nevada (Salesperson Only), Oklahoma, Pennsylvania These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

Maryland Real Estate Links |

Maryland Real Estate Customs

Attorneys conduct closings, and there has to be a local attorney involved.

Conveyance is by grant deed, and the deed must state the consideration involved. Although mortgages are common in some areas, deeds of trust are more prevalent as security instruments. Security instruments may include a private power of sale, so it naturally is the foreclosure method of choice.

Maryland uses ALTA policies and endorsements.

Buyers pay closing costs, title insurance premiums, and transfer taxes.

Property taxes are due annually.

* Police officers in Prince George’s County who are first-time home buyers get a break on their transfer taxes at closing under a law that took effect July 1, 2006. Officers pay 1 percent of the purchase price rather than 14%, the regular rate. County school teachers were made eligible for the same tax break in an earlier law without the first-time buyer limitation. Teachers must commit to living in the house for at least three years and maintain their teaching position with the county during that time.

Conveyance is by grant deed, and the deed must state the consideration involved. Although mortgages are common in some areas, deeds of trust are more prevalent as security instruments. Security instruments may include a private power of sale, so it naturally is the foreclosure method of choice.

Maryland uses ALTA policies and endorsements.

Buyers pay closing costs, title insurance premiums, and transfer taxes.

Property taxes are due annually.

* Police officers in Prince George’s County who are first-time home buyers get a break on their transfer taxes at closing under a law that took effect July 1, 2006. Officers pay 1 percent of the purchase price rather than 14%, the regular rate. County school teachers were made eligible for the same tax break in an earlier law without the first-time buyer limitation. Teachers must commit to living in the house for at least three years and maintain their teaching position with the county during that time.