Ohio Out of State Broker CooperationAn out-of-state licensee can perform work on a transaction involving commercial real estate*, so long as the out-of-state licensee:

a) enters into a written agreement with Ohio broker; b) files consent to jurisdiction in Ohio; c) furnishes certificate of good standing in home state to Ohio broker; d) all funds received are deposited in Ohio broker's escrow account. * defined as any property except property with 1 to 4 residential units or condominiums, townhouses, manufactured homes, or individual homes which are sold individually, even though they are part of a larger group. |

|

|

Ohio Real Estate ReciprocityArkansas, Connecticut, Kentucky, Mississippi, Nebraska, Oklahoma, West Virginia, Wyoming*

* These State Licensees must take the Ohio Real Estate Law Course and pass the State portion of the Ohio Real Estate Exam. Confirmed by the Ohio Division of Real Estate and Professional Licensing |

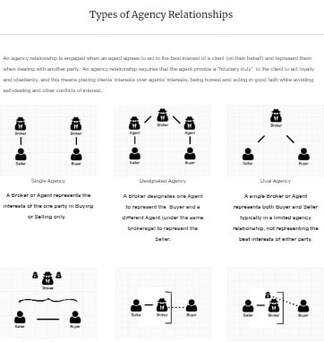

Specific to Ohio Real Estate - Must maintain a Trust account. - Must have a physical location as a place of business. - OH is considered a Single Entity State, meaning that a Broker in this state can only represent one entity, whereas a broker in other states may represent multiple entities. "A licensed real estate broker who is a member or officer of a partnership, association, limited liability company, limited liability partnership, or corporation shall only act as a real estate broker for such partnership, association, limited liability company, limited liability partnership, or corporation." - Section 4735.13 |

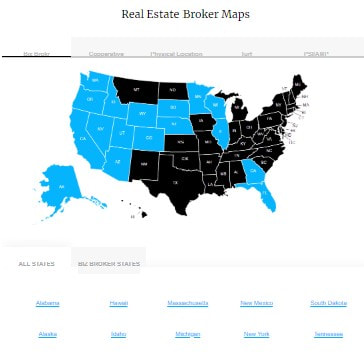

Ohio Reverse ReciprocityThese states specifically mention Ohio in their Reciprocity: Arkansas, Connecticut, Nevada (salesperson only), West Virginia. These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

Ohio Real Estate Links |

Ohio Real Estate Customs

Title companies and lenders handle closings.

Conveyance is by warranty deed. Dower rights require that all documents involving a married person must be executed by both spouses. Mortgages are the security instruments.

Ohio uses ALTA policies; they get a commitment at closing and a policy following the recording of documents.

Buyers and sellers negotiate who’s going to pay closing costs and title insurance premiums, but sellers pay the transfer taxes.

Property tax payment dates vary throughout the state.

Conveyance is by warranty deed. Dower rights require that all documents involving a married person must be executed by both spouses. Mortgages are the security instruments.

Ohio uses ALTA policies; they get a commitment at closing and a policy following the recording of documents.

Buyers and sellers negotiate who’s going to pay closing costs and title insurance premiums, but sellers pay the transfer taxes.

Property tax payment dates vary throughout the state.