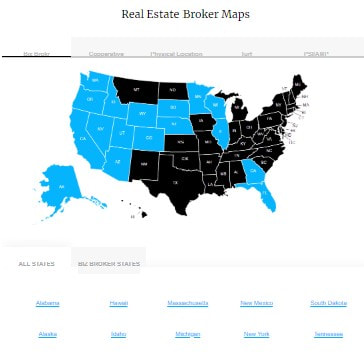

North Carolina Out of State Broker Cooperation- A limited real estate license can be obtained from the Commission, so long as the out-of-state licensee is affiliated with a North Carolina licensee and its license is in good standing.

- License is issued for a limited time and only applies to real estate transactions. |

|

|

North Carolina Real Estate ReciprocityAny State*

* Must pass State portion of the North Carolina Real Estate Exam "An applicant who holds a current real estate license in another state (or U.S. territory or Canadian jurisdiction) that has been on active status within the previous three years may qualify to waive the Prelicense course and the “National” section of the North Carolina real estate license examination, but the applicant must pass the “State” section of the examination. See pp 4-7 of RELINC." |

Specific to North Carolina Real Estate A Reciprocal License is only available if you take courses in person in NC after you apply for a provisional reciprocal license. Online (distance learning) is not allowed or provided. |

North Carolina Reverse ReciprocityThese states specifically mention North Carolina in their Reciprocity: None These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

North Carolina Real Estate Links |

North Carolina Real Estate Customs

Attorneys or lenders may handle closings, and corporate agents issue title insurance.

Conveyance is by warranty deed. Deeds of trust with private power of sale are the customary security instruments.

North Carolina uses ALTA policies, but these require an attorneys opinion before they’re issued.

Buyers and sellers negotiate the closing costs, except that buyers pay the recording costs, and sellers pay the document preparation and transfer tax costs. Property taxes fall due annually on the last day of the year.

Conveyance is by warranty deed. Deeds of trust with private power of sale are the customary security instruments.

North Carolina uses ALTA policies, but these require an attorneys opinion before they’re issued.

Buyers and sellers negotiate the closing costs, except that buyers pay the recording costs, and sellers pay the document preparation and transfer tax costs. Property taxes fall due annually on the last day of the year.