South Carolina Out of State Broker Cooperation- An out-of-state licensee may split a commission with a South Carolina licensee so long as out-of-state licensee does not conduct any negotiations while physically within the state.

- Nothing in South Carolina bars a licensee from bringing a lawsuit for a commission. |

|

|

South Carolina Real Estate ReciprocityGeorgia*

* Must be a resident in this State and have taken the written exam there. It's really hidden on the South Carolina Real Estate Commission website, but this page outlines Reciprocity. "SCREC recognizes the qualifications of licensees of other jurisdiction, however one must still must apply for and take the SC portion of the real estate examination (and if applying to become a broker, meet the 3 years actively licensed sales experience requirements). With your examination application, you will need to submit certification(s) of licensure from any jurisdiction(s) in which you have held licensure in the last 5 years. You must also have been licensed within 6 months prior to SC Application." |

Specific to South Carolina Real Estate |

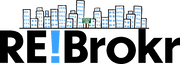

South Carolina Reverse ReciprocityThese states specifically mention South Carolina in their Reciprocity: West Virginia These States recognize any other State licenses but may have additional requirements: Alaska, Alabama, Colorado, Georgia, Idaho, Indiana, Kansas, Kentucky, Maine, Nebraska, North Carolina, Rhode Island, South Dakota, Tennessee, Vermont, Washington |

South Carolina Real Estate Links |

South Carolina Real Estate Customs

Attorneys customarily handle closings.

Conveyance is by warranty deed. Mortgages are most often the security instruments.

South Carolina uses owner’s and lender’s ALTA policies and endorsements.

Buyers pay closing costs, title insurance premiums, and state mortgage taxes; sellers pay the transfer taxes.

Property tax payment dates vary across the state.

Conveyance is by warranty deed. Mortgages are most often the security instruments.

South Carolina uses owner’s and lender’s ALTA policies and endorsements.

Buyers pay closing costs, title insurance premiums, and state mortgage taxes; sellers pay the transfer taxes.

Property tax payment dates vary across the state.